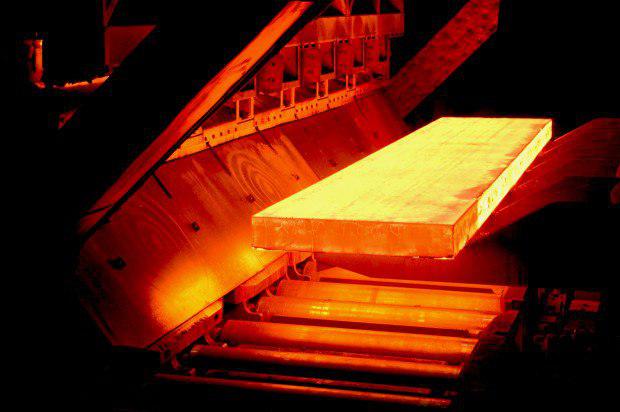

Last week CIS billet prices remained stable again, confirming the global uncertainty for the future direction of steel prices. The latest measures aimed at reducing exports, both in China and Russia, are expected to support global prices in the near future, but other factors could limit the positive trend.

CIS billet exporters have closed July allocations with a series of sales, which went as low as $620/tonne fob Black Sea towards the end of last week. The planned export duty implementation on 1 August has not yet boosted Black Sea billet prices, as was expected by traders, but the rebound may happen soon.

Prices were declining gradually over the course of last week, starting with sales at $640/t fob Black Sea for Russian billet, and ending at $620/t fob for Ukrainian material. Demand declined considerably as buyers continued to digest the news, and there were no flash sales of billet similar to Russian hot rolled coil. Scrap-based producers, who would suffer most from the duties, were officially opposing their implementation and mulling their next steps.

One of these mills tells it would rather reroll its traditionally exported billet into finished products and sell in the domestic market, as it would not make sense to export anything at cost-of-production level. Russian EAF based mills’ cost of production is around $515/t exworks. Adding transportation to port and handling fees, this would be $550/t fob for some producers. “There is simply no room for adding $115/t export duty, unless billet prices magically exceed $670-680/t fob at the least,” one market participant says. Some participants expect an imminent price rise, after July-casting volumes have been sold and the market has a chance to recuperate for August-casting bookings. Many traders continue to foresee billet prices rebounding as a natural reaction to high scrap prices, duties, and the ongoing long products market recovery. India’s post-Covid-19 recovery will also add to the rebound, one trader says, and it will be swift, with the country’s exports disappearing completely in Asia, once its construction activity recovers. New offers of billet are not expected below $670-680/t fob, and with some August books already sold, traders wonder how long CIS suppliers will wait before offering. Whether Ukrainian mills are going to take advantage of having no duty and selling at buyers’ bids levels – currently at $600-610/t fob – will largely decide the fate of Russia’s billet market in July, traders conclude.