By Paul Lim, Zihuan Pan – Tuesday 14 September

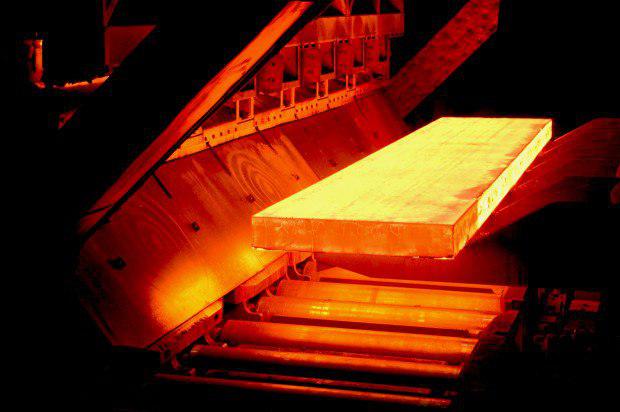

Domestic hot-rolled coil prices in China dropped on Tuesday September 14, with trading activity weakening and adverse weather constraining deliveries while sentiment deteriorated on a tumbling raw material market.

Domestic

Eastern China (Shanghai): 5,770-5,820 yuan ($895-903) per tonne, down by 80 yuan per tonne

The spot HRC market came to a near standstill in the afternoon, with the sharp price decline earlier in the day prompting downstream consumers to rethink their purchasing plan.

HRC futures on the Shanghai Futures Exchange experienced a steep drop in the afternoon after the coking coal and coke contracts on the Dalian Commodity Exchange fell for a third day. The National Development & Reform Commission had earlier this week instructed coal producers to help stabilize prices by entering into long-term contracts and expanding capacity, according to local media reports.

The coking coal and coke contracts’ pullback from record highs sparked risk aversion sentiment among market participants, weighing on HRC futures and subduing liquidity in the spot market, a Shanghai-based trader said.

Spot HRC trading liquidity was also affected by Typhoon Chanthu on Tuesday, which hit eastern China and constrained the movement of cargoes into and out of warehouses.

But demand is weak not just in eastern China but generally across the country, the trader added.

Export

Fastmarkets’ steel hot-rolled coil index export, fob main port China: $935.88 per tonne, down by $1.86 per tonne

Thin trading coupled with the domestic price decreases led some traders to lower their offers by about $10 per tonne.

But some traders also kept their unchanged because they do not think there is a lot of downside for domestic prices due to shrinking supply and an anticipated recovery of demand.

Trading companies and mills were offering SS400 HRC at $930-980 yuan per tonne fob on Tuesday. Sources there indicated that they were willing to sell at minimum prices of $930-940 per tonne.

A major mill in northern China kept its base price of $1,000 per tonne fob unchanged. A source at the mill said its sales had been poor in the past week.

A major Russian steelmaker is now attempting to o.er 30,000 tonnes of December- and January-shipment material at $880 per tonne cfr Ho Chi Minh City or Haiphong. No bids were heard at the time of writing.

Market chatter

“It’s really hard to sell mainstream grades of Chinese HRC now amid the sustained uncertainties over whether an export duty would emerge and the availability of cheaper cargoes from the Commonwealth of Independent States, Russia, India and other regions. Even though the likelihood for the export duty to be imposed in the near term is low, buyers are more likely to prefer to avoid such a risk,” a second Shanghai-based trader said.

Shanghai Futures Exchange

The most-traded January HRC contract ended at 5,689 yuan per tonne on Tuesday, down by 116 yuan from Monday’s close.

(MetalBulletin, 14 Sep, 2021)